How to Evict a Tenant From Your Property

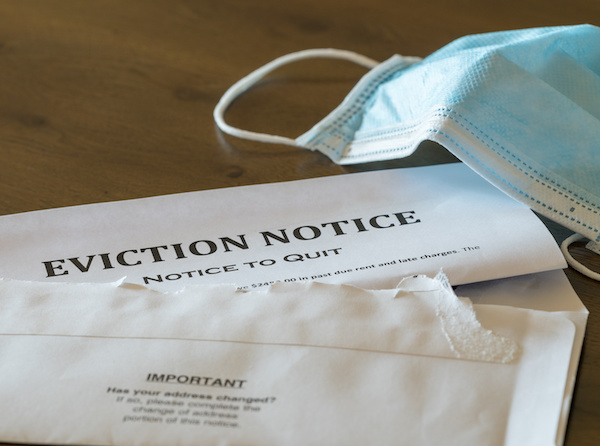

The Eviction Ban Has Ended, How to Evict Your Tenant?

Now that the eviction ban has ended, many landlords are wondering how to evict a tenant from their house. Evicting a tenant is a difficult situation that is usually resulting from non-payment of rent or some type of lease violation. The process is time consuming and very draining.

However, if you decide to work with your tenant, you can offer a payment plan for those who have fallen behind. Many landlords have offered this to their tenants, but if that isn’t an option, then the only available option will be eviction. This is an unavoidable eventuality for all landlords.

Since the beginning of the pandemic and with the eviction moratorium, many landlords found themselves in an impossible situation with their tenants for non-payment. Now that the eviction ban has been lifted, many landlords are wondering how to process an eviction and what has changed.

Evictions Are on The Rise, But is it Legal?

The Federal ban on evictions ended in August 2021. Unfortunately for many landlords, there are state and local moratoriums that have protected tenants from eviction. Some reports say that up to 50% of all tenants are protected by these state and local moratoriums.

Evictions have been on the rise since August 2021. Eviction cases have risen over 40% in Houston, Dallas and Philadelphia. However, for landlords living in states or cities where there are still eviction protections for tenants, these bans will continue through early 2022. Furthermore, there are 6 states where the eviction ban will go through till July 1, 2022. These states are Indiana, Massachusetts, Michigan, Nevada, New Mexico and Washington.

These bans on evictions only postpone eviction to a later date. After the ban ends, the tenants will still owe the rent. But one good thing for landlords to know is that the option to evict an unruly tenant can happen and isn’t protected by the ban on evictions. For example, if you find your tenant engaged in criminal or illegal activities, you may evict them. Talk with your real estate attorney for more information.

How to Evict Your Tenant After The Eviction Moratorium Ends

As we enter the new year and more of the bans on evictions come to an end, evictions will continue to rise. In most cases, landlords will have to evict their tenants who are not able to pay the back rent due. Some tenants may offer to pay partial payments, and that will be up to your discretion. Despite the nuances of individual tenants, if you will be evicting your tenant(s), it will be important to follow the proper steps to evict a non-paying tenant or a tenant who has violated their lease. These are the important things you need to know.

1. Knowing your local laws

Depending on where you live, the laws will be different, so it’ll be pertinent for you to read on the current eviction laws in your city. Regardless of the federal ban on eviction ending, there may still be other protections for tenants in your state/city.

Furthermore, eviction and tenant laws differ from state to state and may require a different process. For example, some states require a 30-day notice before filing an eviction action while other states require a 60-day notice. If it is difficult for you to find this information, you’ll want to hire an attorney to help you.

2. Do you have valid reasons for eviction?

Before you can take any legal action against your tenant, you need to make sure you are evicting them for valid legal reasons. In order to ensure you are compliant, you should review the tenancy agreement terms and make sure the violation is listed.

Beyond non-payment, there are many other reasons to evict a tenant. These can include, not paying rent on time, property damage, violating a pet policy, disrupting other tenants or subletting.

Ultimately, in order for you to evict a tenant, you’ll want to make sure you have solid documentation to support your cause for eviction. Otherwise, it’s a we said, they said situation.

3. Time to issue the eviction

Now that you know what your local laws are and you have documentation for the eviction, it’s time to serve proper notice of eviction. Most states will require that you do this before you start the eviction proceedings.

There are three different types of eviction notices usually served:

- Pay rent or quit

- Cure or quit

- Unconditional notice to leave

The first option, pay rent or quit, will be what most landlords will use as it requires the tenant to pay the due rent within the stated period of time or face a lawsuit.

The second option, cure or quit, gives the tenant a short period of time to resolve the rent violation. For example, a tenant removing a guest who has become an unlawful occupant.

The third option, unconditional notice to leave, is only meant for serious breaches of the rental agreement. For example, conducting illegal or criminal activities on the premises.

Lastly, do not be tempted to carry out any self-guided evictions. These types of actions are illegal and unethical. An example of this is forcing the tenant to leave by changing the locks or shutting off utilities.

4. File an eviction lawsuit

Now that you’ve issued the eviction notice, it’s time to file the eviction lawsuit at your local court. Typically, you have to wait 30 days after you serve the notice, but as mentioned prior, it may be 60 days. For this step, you will need to provide the clerk with all your documentation which should include the following:

- Copy of the lease

- Payment records

- Eviction notice

- Documentation of any other lease violations

5. Evict delinquent tenant

This is the final step and sometimes it comes with drama. Once the judge rules in your favor, then you can remove the tenant and get your property back. We can hope that the tenant will leave without destroying your property, but if they do not willingly leave, you will most likely call law enforcement officials to help you carry out the eviction.

Once the tenant has moved out, you may be entitled to claim any back rent that was never paid. However, before tossing any property of your tenant’s out, you’ll need to make sure you know the local laws. Some states will require you store their possessions for a time while other states will require you to toss it all out.

Why You Shouldn’t Accept Partial Payment

You might have some savvy tenants, or they may have seen a video or read a blog on how they can delay their eviction. If you have not agreed on a partial payment plan with your tenant, then it will be important to not accept any money from your tenant. For example, if your tenant paid you $1 after you issued your eviction notice, you’ll have to wait another 30 days before you can file the eviction with the court, from that day. Therefore, it’s going to be paramount for you to make it impossible for your tenant to give you money. If you are accepting rent using a digital wallet like Paypal, Cash App or Venmo, then you may not be able to block their payments, which will continue extending your ability to file the eviction lawsuit.

Now that you know how the eviction process works, you can start getting yourself prepared for evicting tenants for non-payment or any other violation to your lease agreement. This isn’t the best part of being a landlord, but neither is having a tenant living rent free in one of your properties. It’s tough for everyone right now and the best thing to do is work together, but when you are at an impasse, eviction may be the only option.